georgia film tax credit 2020

4 2020 Georgia Gov. On August 4 2020 Governor Kemp signed into law HB.

Q A For Landlords Georgia Rental Assistance Program Part Two Georgia Department Of Community Affairs

An additional 10 percent uplift can be earned by including an embedded animated or static Georgia promotional logo provided by the Georgia Film Office.

. 20 base transferable tax credit. 1037 was drafted in response to a report released earlier this year by the Georgia Department of Audits and Accounts DOAA. The Georgia Entertainment Industry Investment Act provides the largest tax credit offered by Georgia and it is the most generous film incentive program in the nation with an estimated 915.

For the film industry the possibility of a newly constituted Statehouse raises the question. Aug 5 2020 1254pm PT Georgia Mandates Audits for Film and TV Tax Credit By Gene Maddaus. 159-1-1-01 Available Tax Credits For Film Video or Interactive Entertainment Production.

The figure is 40 higher than the states previous record. The bill removes the right of recapture by the state of any tax credits that undertake the new audit process and clarifies many related rules. The income bill passed out the Senate.

Georgia doled out a record 12 billion in film and TV tax credits last year far surpassing the incentives offered by any other state. Georgias popular Film Tax Credit will undergo significant changes as of January 1 2021. Jeff Glickman JD LLM Partner-in-Charge of State and Local Tax Services at Aprio LLP.

The bill amends Georgia Code Section OCGA. The Georgia film tax credit grew nearly tenfold over the last decade from 89 million in 2009 to. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of 2600.

30 2022 at 352 PM PDT. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. Before sharing sensitive or personal information make sure youre on an official state website.

Georgia Film Tax Credit. The new law appears to be in response to an audit report issued by the Department of Audits and. This bill became effective on January 1 2021.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax returns. Georgia House Bill 1037 was signed into law by the Georgia Governor on August 4 2020.

Local state and federal government websites often end in gov. The-board flat tax credit of 20 percent to certified projects based on a minimum investment of 500000 over a single tax year on qualified expenditures in Georgia. House Bill 1037 HB.

The report revealed the use of inadequate procedures by the Georgia Department of. Brian Kemp signed House Bill 1037 which requires mandatory audits of film tax credits. Brian Kemp last week approved changes to the Georgia Entertainment Industry Investment Incentive Act that require mandatory audits by productions before applying for the 30 tax credit the.

Unused credits carryover for five years. CBS46 - A big development today in the effort to limit Georgias tax credit for the film industry. What changes could be in store for Georgias entertainment tax credit program which handed out 870.

Georgia is a production-friendly state with transferable film tax credits up to 30 of qualified expenditures. This rule provides guidance concerning the application and qualification guidelines contained within the Georgia Entertainment Industry Investment Act hereinafter Act under OCGA. In that context the states annual subsidy for.

There are two separate credits made available under the Act. Last Friday the state Senate passed 26 billion in cuts including more than 1 billion in cuts to K-12 education. 1037 which enacts significant procedural changes to the states film tax credit allowed pursuant to OCGA.

The film tax credit is a good deal for Georgia. By Staff on December 14 2020 News. These audits can be conducted by third-party CPAs who meet certain criteria the bill says.

The Georgia film tax credit has worked as intended and built an industry that spends nearly 3 billion per year in the state and employs tens of thousands of Georgians in high-paying jobs the Georgia Screen Entertainment Coalition said today in response to the state of Georgias audit. By Staff on January 12 2020 Features. The passage of Georgia House Bill 1037 also caused Georgia Rule 5607845 to be amended.

Georgia Senate Panel Proposes 900 Million Cap On Film Tax Credit Variety

Sugar Creek Capital Film Entertainment Tax Credits

Medsurg Ati Proctored Exam Test Bank A 1 Baptist College Of Health Sciences Med Surg 351

Guest Essay Five Reasons Why Georgia Should Yell Cut On Film Tax Credit Arts Atl

The Secret Sauce Of Georgia S Extraordinary Film Industry Georgians Saportareport

Updates On Georgia State Tax Credits What You Need To Know Mauldin Jenkins

Small Business Incentives Georgia Department Of Economic Development

Film And Tv Spending In Georgia Hits 4 4b

October 2018 Google Play Baseball Cards Mitchell

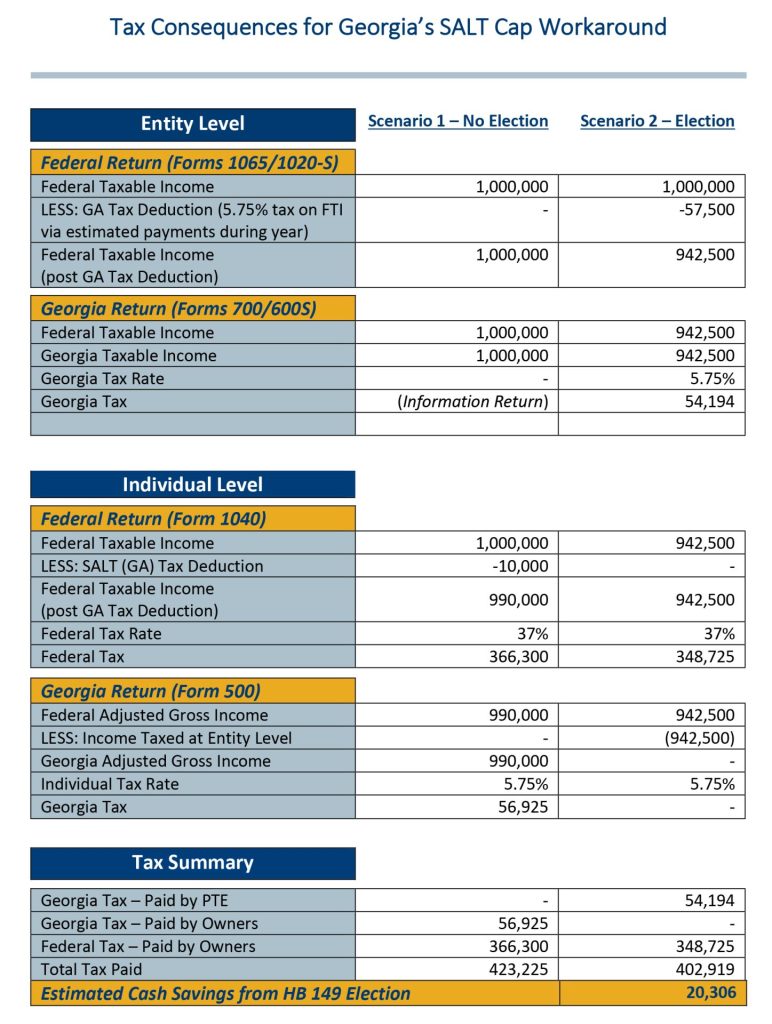

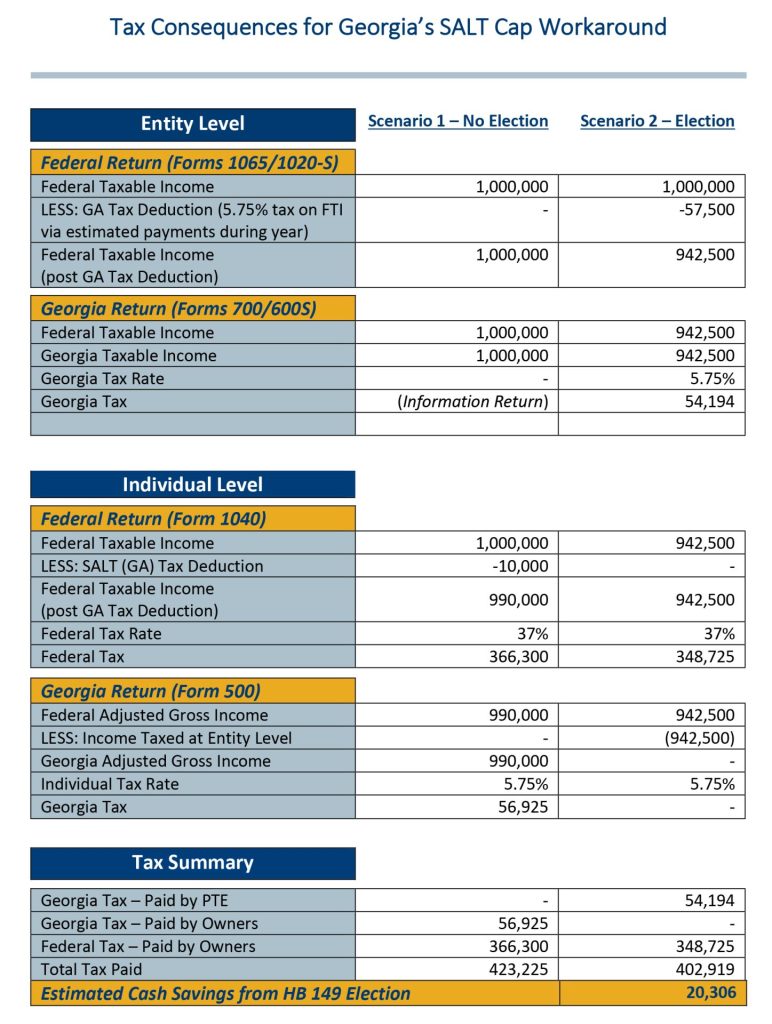

The Benefits Of Georgia S Salt Cap Workaround Bennett Thrasher

The Jolt Stacey Abrams Head Start On November Touts Saving Film Industry